Programming and Registration for Activities

To register for activities and recreation classes, please access the Amilia platform.

Additional information below

Film camp

August 18 to 22, from 9 a.m. to 4 p.m.

Registration fee: $100 / week

Online registration from June 2 to August 10

Experience an immersive week in the world of cinema with a local filmmaker!

This unique camp is designed for youth aged 9 to 14 who dream of creating their own film.

Guided by a professional, participants will learn to write a script, act, film, and edit a short movie from start to finish. Each day will focus on a different stage of the creative process, all with one goal: to produce a real film as a team!

No experience required — just curiosity, creativity, and a passion for cinema. The finished short film will be screened at the end of the camp.

This camp is offered under the L’été des Salamandres program, in a safe and inspiring environment.

Summer Day Camp

The Salamander Summer Day Camp is a bilingual camp for children aged 5 to 13 years old. Compliant with the Terms of Reference of the Association des camps du Québec (ACQ), it has been welcoming local children for over 20 years. We believe that summer is a special time for children and we love to see them create new friendships and make exciting discoveries.

Online registration will begin on April 2 at 5 p.m.

Registration Information

Online registration will be open from April 2 at 5 p.m. to May 11, following the priority order outlined below:

- April 2 to 12: Residents of Lac-Brome

- April 21 to 27: Residents of Lac-Brome & Bolton-Ouest

- April 28 to May 11: All other cities

A limit on the number of spots available will be set based on the quantity of hired animators.

Payment:

Online via credit card

In-person via credit card, cash, or check.

Proof of Residence Required:

Please have proof of residence ready during registration.

Children are considered residents based on the place of residence of their parent(s), grandparent(s), or legal guardian(s) for the municipalities of Lac-Brome and West-Bolton.

Schedule

The camp runs for a duration of 8 weeks: from June 25 to August 15, 2025, Monday to Friday, from 9 am to 4 pm.

Childcare Service:

To make the camp even more accessible to families, a childcare service is offered from Monday to Friday.

To accommodate parents’ morning routines, the childcare service will now be available 30 minutes earlier.

Hours: 7 am to 9 am and 4 pm to 5:30 pm

Fees

Contact Us

Service des loisirs, tourisme, culture et vie communautaire

270 Victoria St., Lac-Brome (QC) J0E 1V0

450 242-2020

facebook.com/vlbtbl

campdejour@lacbrome.ca

Mois du vélo

The Town of Brome Lake is proud to take part once again this year in this initiative proposed by Vélo Québec. A variety of activities are offered to cycling enthusiasts in Brome Lake, whether they are experienced or beginners.

Soccer

Every summer season, players are invited to register for the Interville Soccer League (U8+) or the Timbits League (micro-soccer) to join teams representing Lac-Brome.

Registration for the 2025 season will begin on February 24 , 2025.

Registration Information

Register online on the Spordle platform starting February 24, 2025.

New Registration Procedure

Complete the form, save it, and upload it on Spordle at the indicated location.

Photos Required for:

- All new U8 players

- All new coaches

- All U8+ players born in May, June, July, and August

When registering on Spordle, upload a photo of the registered player from the shoulders up against a white background.

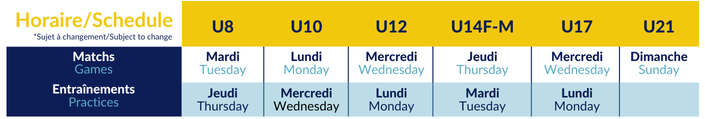

Schedule

Fees

Referees

Individuals interested in officiating during the 2025 season are invited to express their interest by emailing soccer@lacbrome.ca.

Volunteer

Parents wishing to become volunteer coaches can select this option on their child's registration form.

Contact Us

Recreation, Tourism, Culture, and Community Life Department

270 Victoria Street, Lac-Brome (QC) J0E 1V0

450 242-2020

facebook.com/vlbtbl

soccer@lacbrome.ca

Pickleball

The Lac-Brome Pickleball Club brings together several hundred members to practice the fastest-growing sport in North America.

The 2025 season will start on April 14.

Information

Online registration begins on March 10.

Class Location: Pickleball courts at Lions Park

Court Location: Lions Park: 37 Centre Road

The courts are not open to the public during reserved times for the Lac-Brome Pickleball Club.

Click here for instructions on how to become a member of the pickleball club.

2024 Schedule

Click here to see the schedule

Time Slots - Regular Play (Courts 1 and 2 regular - Court 3 competitive if desired)

- Sunday - 10 AM to 2 PM

- Monday - 9 AM to 12 PM

- Tuesday - 5 PM to 8 PM

- Wednesday - 9 AM to 12 PM

- Thursday - 5 PM to 8 PM

- Friday - 9 AM to 12 PM

- Saturday - 11 AM to 2 PM

Time Slots - Special Games or Tournaments

- Sunday - None

- Monday - None

- Tuesday - Recreational Play + Skills - 2 PM to 5 PM

- Wednesday - None

- Thursday - Competitive Play - 2 PM to 5 PM

- Friday - Friday Fun - Tournaments - Events - 5 PM to 9 PM

- Saturday - Skills and Drills - 9 AM to 11 AM

Fees

$35 to become a member of the Lac-Brome Pickleball Club.

Contact Us

Recreation, Tourism, Culture, and Community Life Department

270 Victoria Street, Lac-Brome (QC) J0E 1V0

facebook.com/vlbtbl

club.pickleball.lac.brome@gmail.com

facebook.com/groups/club.pickleball.lac.brome

Tax Credits

For Children’s Activities

The cost of some of our activities for children may be eligible for deductions on your family’s income taxes. Please save your receipt from registration to include with your tax return. If you misplace your receipt, please call us so we can send you a replacement. Please consult the websites of the Canada Revenue Agency or Revenu Québec for more information.

Family Rates

For Residents of Town of Brome Lake

Please call us at 450 242-2020 for details of our Family Discounts.

Swimming lessons

Swimming lessons are offered at Douglass Beach starting from July 2 and lasting for a duration of 8 weeks. The minimum age accepted for registration is 3 years old (Preschool).

The Town offers these courses in accordance with the Nager pour la vie program of Société de Sauvetage.

Registration Informations

Online registrations from June 2 to June 29.

It is suggested:

- to wear a wetsuit

- to arrive 10 minutes early for the class

Levels:

PRESCHOOL (3-5 years old)

Parent and Child 3: Designed for children aged 2 to 3 to help them appreciate water with the parent.

Preschool 1: These preschoolers will have fun learning to get in and out of the water. We’ll help them jump into chest deep water. They’ll floats and glide on their front and back, and learn to get their face wet and blow bubbles underwater.

Preschool 2: These preschoolers learn to jump into chest deep water by themselves, and get in and get out wearing a lifejacket. They’ll submerge and exhale underwater. While wearing a lifejacket they’ll glide on their front and back.

Preschool 3: These youngsters will try both jumping and a sideways entry into deep water while wearing a lifejacket. They’ll recover objects from the bottom in waist-deep water. They’ll work on kicking and gliding through the water on their front and back.

JUNIOR (5-12 years old)

Swimmer 1: These beginners will become comfortable jumping into water with and without a lifejacket. They’ll learn to open their eyes, exhale and hold their breath underwater. They’ll work on floats, glides and kicking through the water on their front and back.

Swimmer 2: These advanced beginners will jump into deeper water, and learn to be comfortable falling sideways into the water wearing a lifejacket. They’ll be able to support themselves at the surface without an aid, learn whip kick, swim 10 m on their front and back, and be introduced to flutter kick interval training (4 x 5 m).

Swimmer 3: These junior swimmers will dive, do in-water front somersaults, and handstands. They’ll work on 15 m of front crawl, back crawl and 10 m of whip kick. Flutter kick interval training increases to 4 x 15 m.

Swimmer 4: These intermediate swimmers will swim 5 m underwater and lengths of front, back crawl, whip kick, and breaststroke arms with breathing. Their new bag of tricks includes the completion of the Canadian Swim to Survive® Standard. They’ll cap it all off with front crawl sprints over 25 m and 4 x 25 m front or back crawl interval training.

Swimmer 5: These swimmers will master shallow dives, cannonball entries, eggbeater kicks, and in-water backward somersaults. They’ll refine their front and back crawl over 50 m swims of each, and breaststroke over 25 m. Then they’ll pick up the pace in 25 m sprints and two interval training bouts: 4 x 50 m front or back crawl; and 4 x 15 m breaststroke.

Swimmer 6: These advanced swimmers will rise to the challenge of sophisticated aquatic skills including stride entries, compact jumps and lifesaving kicks like eggbeater and scissor kick. They’ll develop strength and power in head-up breaststroke sprints over 25 m. They’ll easily swim lengths of front crawl, back crawl, and breaststroke, and they’ll complain about the 300 m workout.

Payment

Online by credit card or in person by credit card, cash, or check.

Schedule (July 2 to August 21)

| Wednesday | Thursday |

| Preschool 1 - 4:30 p.m. to 5 p.m. | Preschool 2 (B) - 4:30 p.m. to 5 p.m. |

| Preschool 2 (A) - 5:05 p.m. to 5:35 p.m. | Swimmer 2-3 (B) - 5:40 p.m. to 6:10 p.m. |

| Swimmer 1 - 5:40 p.m. to 6:10 p.m. | Swimmer 4-5 - 6:15 p.m. to 7 p.m. |

| Swimmer 2-3 (A) - 6:15 p.m. to 6:45 p.m. |

Tarifs

| Residents | Non-Residents |

| Preschool 1-2 - $55 | Preschool 1-2 - $105 |

| Swimmer 1-2-3 - $55 | Swimmer 1-2-3 - $105 |

Simmer 4-5 - $60 | Simmer 4-5 - $110 |

Aquafit & Aquajogging

Aqua Fitness and Aquajogging classes are offered by Cindy Cleary at Douglass Beach starting June 30 for a duration of 8 weeks. The minimum age for registration is 16.

Start your week off right with a guided workout by Cindy, an experienced aqua fitness instructor, in the beautiful setting of Brome Lake. Aquafit, held in shallow water, focuses on rhythmic movements to gently improve your cardio, strength, and mobility.

For an extra challenge, try aquajogging: a deep-water version using a flotation belt that provides a full-body, impact-free workout. Whichever option you choose, you'll leave feeling energized in a friendly and refreshing atmosphere.

Registration Informations

Online registrations from June 2 to June 29.

Schedule (June 30 to August 18)

| Monday - 9 a.m. to 10 a.m. | Monday - 10 a.m. to 11 a.m. |

| Aquajogging | Aquafit |

Fees

| Residents | Non-Residents |

| 16 to 59 y.o : $70 60 to 69 y.o: $45 70 + : Free | 16 to 59 y.o : $125 60 to 69 y.o: $125 70 + :$125 |

Sup Yoga & Pilates

Dive into a unique experience every Tuesday evening with our yoga and Pilates class on paddleboards, right on the calm waters of the lake. Combining the balance and flexibility of yoga with the strength and stability of Pilates, this class invites you to move in harmony with the water.

Practicing on the board adds a new dimension, enhancing your balance, flexibility, and focus. Whether you're a beginner or more experienced, this activity is perfect for strengthening your body while enjoying the tranquility of the lake and its natural surroundings. End your day on a high note, with a calm body and mind.

Registration Informations

Online registrations from June 2 to June 29.

SUP provided freely.

Schedule (July 1st to August 19)

| Tuesday - 4:30 p.m. to 5:15 p.m. |

| SUP Yoga & Pilates |

Fees

| Residents | Non-Residents |

| 16 to 59 y.o : $70 60 to 69 y.o: $45 70 + : Free | 16 to 59 y.o : $125 60 to 69 y.o: $125 70 + :$125 |

Water excursion

Set Out on the Water Every Tuesday Evening

Join us every Tuesday at 5:20 p.m. from Douglass Beach for our free paddle outings (paddleboard, canoe, kayak, etc.). As a group, you'll follow a calm route across Brome Lake, taking in its peaceful scenery and a stunning sunset.

Whether you're solo, with friends, or with family, it's the perfect opportunity to get moving, socialize, and reconnect with nature—on the water.

Registration Information

Free and open activity – No registration required.

You can reserve a paddleboard online for free (for the full session only).

Boards will be assigned for the season on a first-come, first-served basis.

Schedule (July 1st to August 19)

| Tuesday - 5:20 p.m. |

| Water excursion on the lake |

Pickup Spikeball & Volleyball

Start Your Week Right with Spikeball & Pickup Volleyball at Douglass Beach!

From June 30 to August 18, every Monday evening, from 5 p.m. to 7 p.m., come move, have fun, and enjoy the sunset in a relaxed and festive atmosphere.

Whether you're a beginner or an experienced player, there's a spot for you on the sand. We provide the equipment, good vibes… and music to keep the energy up! Bring your crew or come meet new people – it’s free, it’s active, it’s summer at its best.

From June 30 to August 18.